Recalculation of Calendar Year 2024 Tax Rates Frequently Asked Questions (FAQs) - Unemployment Insurance

- Why were rates recalculated?

- How do I know if my rate changed due to the recalculation?

- Will my rate increase due to the recalculation?

- Which employers had rates recalculated?

- If I received the new employer rate for Calendar Year 2024, will my rate be recalculated?

- If I received the foreign contractor rate for Calendar Year 2024, will my rate be recalculated?

- Why did I receive a new rate notice if my rate was not changed?

- What if I have already paid my contributions for Quarter 1 of 2024?

- What if I have already disputed my earned rate for Calendar Year 2024 and I want to withdraw the request?

- What if I have already appealed my earned rate for Calendar Year 2024 to the Lower Appeals Division and I want to withdraw the request for an appeal?

- What should I do if I haven’t filed or paid my taxes for Quarter 1 yet?

- Can I speak with someone at the Division of Unemployment Insurance about the recalculation?

1. Why were rates recalculated?

In recent years, temporary provisions provided special calculation methods for contribution rates to mitigate the impact of high job losses and UI claims during the pandemic. This January, the Maryland Division of Unemployment Insurance issued its rates based on an interpretation that treated a provision of that relief as no longer being in effect. Based upon further review, the Division has reissued rates that will continue the existing relief for one additional year.

2. How do I know if my rate changed due to the recalculation?

All rates remained the same or were lowered. If your rate was lowered due to the recalculation, the new tax rate will appear in your BEACON employer portal on Wednesday, March 27. All employers will get a reissued rate notice with further explanation on the recalculation starting Monday, April 1. Employers who receive correspondence electronically will get an email/text alert that it is in their BEACON portal on April 1; those who opt for U.S. mail will have it mailed beginning April 1.

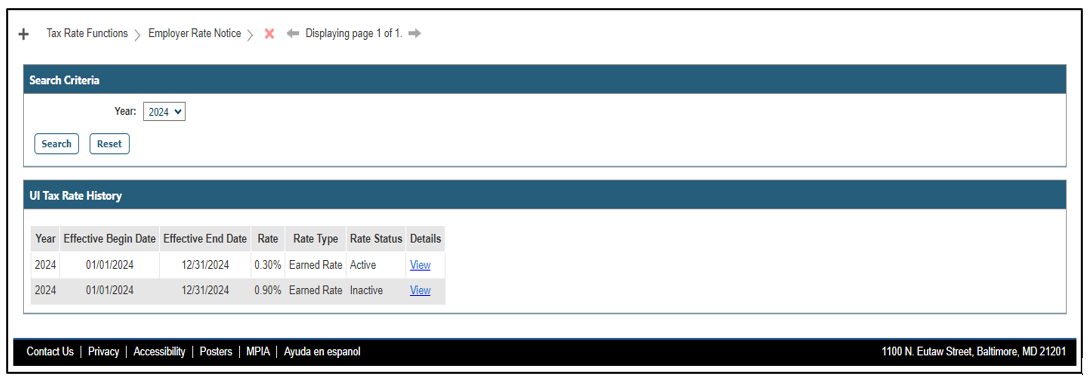

To check if your rate has changed, click “Tax Rate Functions” on the menu on the left side of your employer portal, select “2024” in the dropdown, and click “Select.” You will see two rates listed under “UI Tax Rate History.” The rate calculated for you in January will be listed as “Inactive,” and the new rate recalculated will be listed as “Active” above it. The screenshot below shows an example of this page:

3. Will my rate increase due to the recalculation?

No employer should see a rate increase from the rate provided in the original 2024 Tax Rate Notice sent in January. A majority of employers will see no change.

4. Which employers had rates recalculated?

Employers who received a Calendar Year 2024 earned or standard rate – which meant they were in operation in the previous fiscal years used in the pre-pandemic comparison period – were recalculated. As in calendar years 2022 and 2023, the Division of Unemployment Insurance has compared two different methods of computing the tax rate (one based on pre-pandemic experience and one based on immediate past years’ experience) and assigned the lower of the two rates to each earned and standard rate employer.

5. If I received the new employer rate for Calendar Year 2024, will my rate be recalculated?

No. Only employers who received an earned or standard rate had their tax rates recalculated because they were in operation in prior years.

6. If I received the foreign contractor rate for Calendar Year 2024, will my rate be recalculated?

No. Only employers who received an earned or standard rating had their rates recalculated. Foreign contractor employers did not have an earned rate in the years used in the comparison period.

7. Why did I receive a new rate notice if my rate was not changed?

All active employers received a new rate notice when the rates for Calendar Year 2024 were recalculated. If your rate was not changed, the new rate notice will have the same rate as the rate notice you received in January.

8. What if I have already paid my contributions for Quarter 1 of 2024?

If you have already paid your contributions for Quarter 1 of 2024 and your rate is lowered by the recalculation, you will receive a credit for the difference that will be used towards a future payment. If you prefer to have the difference refunded, click “Click here for a refund” on the homepage of your BEACON employer portal (under “Total Unpaid Taxes and Amount Due” on the right side of the homepage).

9. What if I have already disputed my earned rate for Calendar Year 2024 and I want to withdraw the request?

If you have already requested a review determination of your 2024 tax rate and the recalculation addresses or corrects the issue you had with the rate, you may decide that you no longer want a review determination. You may withdraw your request for a review determination by sending an email to dluicexperiencerating-labor@maryland.gov and ask to withdraw the request. Please include your employer account number associated with the request in the email.

10. What if I have already appealed my earned rate for Calendar Year 2024 to the Lower Appeals Division and I want to withdraw the request for an appeal?

If you have already appealed a review determination decision of your 2024 tax rate to the Lower Appeals Division and the recalculation addresses or corrects the issue you had with the rate, you may withdraw your appeal in BEACON (by clicking on the Appeal menu on the left side of your employer portal, finding the appeal in question, clicking on the appeal case number, and clicking “Withdraw Appeal”); by emailing the Lower Appeals Division with the relevant information at uilowerappeals.labor@maryland.gov; or by mailing the Lower Appeals Division with the relevant information at:

Lower Appeals Division

2800 W. Patapsco Avenue

Baltimore, MD 21230.

11. What should I do if I haven’t filed or paid my taxes for Quarter 1 yet?

If you haven’t filed your quarterly contribution report (or “wage report”) for Quarter 1 of 2024 yet, please file your quarterly contribution report via your normal means of doing so. Most employers file their contribution reports on BEACON, but some employers with large payrolls file by file transfer protocol (FTP) via BEACON. After you file your contribution report, your amount due for the quarter will be calculated using your new rate, and you can pay as you would normally (online in BEACON or by check). Contributions reports and UI taxes assessed for Quarter 1 are due on April 30, 2024.

12. Can I speak with someone at the Division of Unemployment Insurance about the recalculation?

To speak with the Division of Unemployment Insurance about the rate recalculation, contact the Employer Assistance Line 8:00 a.m. EST to 4:30 p.m. EST Monday through Friday at (410) 949-0033 or toll-free at 1-800-492-5524. You can also email the Employer Assistance Unit at dluiemployerassistance-labor@maryland.gov for questions about the rate recalculation.

Dated March 27, 2024

Back to Top