Stock Acquisitions (Commercial Banks and Bank Holding Companies) - Financial Regulation

Last reviewed/updated: August 1, 2024

Pursuant to Md. Code Ann., Fin. Inst. (“FI”) § 3-314 , a stock acquisition is:

- An acquisition of the outstanding voting stock of a commercial bank or bank holding company in this State if the acquisition will affect the power to direct or to cause the direction of the management or policy of any banking institution or bank holding company; or

- An acquisition of any voting stock of a commercial bank if the acquisition will give any one person control of 25 percent or more of the voting stock of the commercial bank.

A person who intends to make a stock acquisition must apply to the Commissioner of Financial Regulation for approval at least 60 days before the acquisition becomes effective. If there is any doubt as to whether a stock acquisition will affect the power to direct or cause the direction of the management or policy of any commercial bank or bank holding company, under the first prong of the definition of “stock acquisition”, the acquirer should resolve the doubt in favor of reporting the proposed stock acquisition to the Commissioner.

Consider the following guidance in determining the applicability of FI § 3-314:

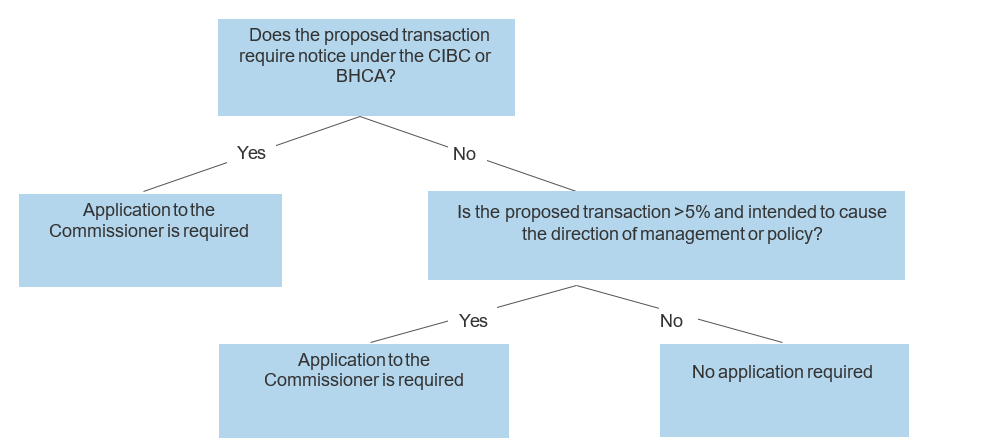

- FI § 3-314 is intended to address stock acquisition concerns in Maryland, comparable to those addressed in both the Bank Holding Company Act of 1956 (BHCA) and the Change in Bank Control Act (CIBC).

- When Maryland revised FI § 3-314 in 1980 the revisor's note stated that the addition of the bank holding company reference was intended to conform to the BHCA.1

- The Commissioner has interpreted the change in bank control aspect of FI § 3-314 to be triggered at 5% when the acquisition is intended to direct or cause the direction of management or policy.2

- The Commissioner also takes guidance from the federal regulatory requirements under the CIBC regarding control when the conditions of the rebuttable presumption of control under federal regulations exist (e.g., the power to vote 10% or more of a publicly held institution or the power to vote 10% or more and no other person holds a greater amount of stock).3

- A transaction may require approval under Md. Code Ann., Fin. Inst. § 3-314 even if it does not trigger similar requirements under federal law due to Maryland’s definition of “stock acquisition.”

- The Commissioner is charged with determining whether any change in control will be anticompetitive or threaten the safety and soundness of the institution.

If a person acquires voting stock in violation of this section, the stock may not be voted for 5 years. Refer to Md. Code Ann., Fin. Inst. § 3-314(e).

NOTE: This specific approval requirement does not apply to an acquisition for which a separate application and approval process is required under Md. Code Ann., Fin. Inst. § 5-904.

Decision tree for acquisition of the outstanding voting stock of a commercial bank or bank holding company in Maryland, if the acquisition will affect the power to direct or to cause the direction of the management or policy of any banking institution or bank holding company:

Contact

- For questions about filing an application or paying an application fee, contact Stephen Clampett, Assistant Commissioner, by phone at 410-230-6104 or by email at stephen.clampett1@maryland.gov.

- Applications should be sent via email to stephen.clampett1@maryland.gov

Application Form

Laws, Rules, and Regulations

A person acquiring equity interests in Maryland chartered banks or bank holding companies of Maryland chartered banks is expected to be knowledgeable about and in compliance with their obligations under Md. Code Ann., Fin. Inst. § 3-314 and any other applicable State and Federal laws, rules, and regulations.

Maryland laws, rules, and regulations can be found by accessing the Annotated Code of Maryland and Rules and Code of Maryland Regulations (COMAR). Certain relevant Maryland laws, rules, and/or regulations include, but are not necessarily limited to:

- Maryland Code, Financial Institutions Article, Title 3, Subtitle 3, Section 314 (Stock Acquisition)

1Laws of Maryland Ch. 33, pgs. 200-202, Revisor’s note https://msa.maryland.gov/megafile/msa/speccol/sc2900/sc2908/000001/000739/html/am739--200.html

2Consent Order and Settlement Agreement, May 22, 2020, IN THE MATTER OF DRIVER OPPORTUNITY PARTNERS I, LP, DRIVER MANAGEMENT COMPANY, LLC and J. ABBOTT R. COOPER

3See, e.g., 12 CFR § 303.82