Foreign Bank Office Permit - Financial Regulation

Last reviewed/updated: September 19, 2025

Maryland law (Md. Code Ann., Fin. Inst. § 12-201 et seq.) requires out-of-state banks or trust companies not headquartered in Maryland to obtain a permit from the Commissioner of Financial Regulation to have an office in Maryland.

Permit and Renewal of Permit

A completed application for each non-branch representative office to be established in Maryland must be submitted to the Office of the Commissioner of Financial Regulation (OFR) for approval. The applicant must:

- Be qualified to do business in Maryland with the Maryland State Department of Assessments and Taxation;

- Provide a certificate of good standing and valid charter from its chartering/home state; and

- Provide a detailed description of the activities it intends to conduct at the proposed office.

The application renewal fee is $500 for each location. OFR encourages all applicant banks and trust companies to pay the application or renewal fee by wire transfer. Please see the contact information below for instructions regarding who to contact for wire instructions. The fee may also be paid by check made payable to the “Office of Financial Regulation” and mailed to OFR.

Upon review and approval, OFR will issue a Foreign Bank Representative Office Permit to the Applicant.

- Permits are valid for three (3) years.

- Permits may be renewed for an additional three (3) years by submitting a renewal application, with the required $500 renewal fee, to OFR at least 30 days before the expiration date of the permit.

- Out-of-state banks and trust companies must inform OFR if any information provided in the permit application (address, activities performed, etc.) changes during the period of the three-year permit. Failure to do so may result in the revocation of the permit.

See below for additional resources and application forms.

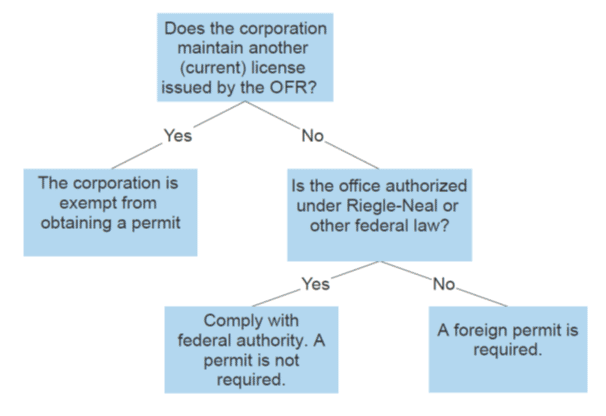

NOTE: A foreign banking corporation that maintains another license with OFR is exempt from obtaining a permit.

Additional Resources

- Banks and trust companies seeking to do business in Maryland are subject to Maryland law (Md. Code Ann., Fin. Inst. § 5-806) regarding the use of “bank” or “trust” in their name.

- Refer to Md. Code Ann., Fin. Inst. § 12-201 et seq.

- More information for depository institutions is available on the Banks, Credit Unions, and Trust Companies page.

Contact

- For questions about filing an application or paying an application fee, contact Stephen Clampett, Assistant Commissioner, by phone at 410-230-6104 or by email at stephen.clampett1@maryland.gov.

- Emailed applications may be submitted to stephen.clampett1@maryland.gov.

- Mailing Address:

Office of Financial Regulation

100 South Charles Street, Tower 1, Suite 5300

Baltimore, MD 21201

Application Forms and Instructions

- Foreign Bank Office Permit Application

- Foreign Bank Office Permit Instructions

- Foreign Bank Office Permit Renewal Application

Laws, Rules, and Regulations

Banking institutions and credit unions are expected to be knowledgeable about and in compliance with Maryland banking laws, and any other applicable State and Federal laws, rules, and regulations. Maryland laws, rules, and regulations can be found by accessing the Annotated Code of Maryland and Rules and Code of Maryland Regulations (COMAR). Certain relevant Maryland laws, rules, and/or regulations include (NOTE: this is not a comprehensive list):

- Maryland Code, Financial Institutions Article, Title 1, Subtitle 2 (General Provisions)

- Maryland Code, Financial Institutions Article, Title 1, Subtitle 3 (Confidential Financial Records)

- Maryland Code, Financial Institutions Article, Title 12, Subtitle 2 (Foreign Banks)