Delinquency Notice and Assessment Notice & Pending Civil Action Letter

When an employer misses quarterly contribution reports and payments, the Maryland Division of Unemployment Insurance sends employers a Delinquency Notice.

If the employer has not resolved the missing reports and payments within 45 days, the Division will send an Assessment Notice and Pending Civil Action Letter.

To avoid legal action, employers must pay the amount due in full within 30 days of receiving the Assessment Notice and Pending Civil Action Letter or request a timely review determination if they disagree with the notice.

Learn more about the Legal Services and Collections Unit.

Payments

You may pay your balance online through the Maryland Unemployment Insurance Portal (BEACON) or by check. Detailed payment instructions are included in the Delinquency Notice and in the Notice of Assessment and Pending Civil Action Letter.

- Maryland Unemployment Insurance Portal (BEACON) for employers login: employer.beacon.labor.md.gov

- Maryland Unemployment Insurance Portal (BEACON) for third-party agents login: agent.beacon.labor.md.gov

Make the check payable to the Maryland Division of Unemployment Insurance Fund and mail it to:

- Division of Unemployment Insurance

PO Box 17291

Baltimore, MD 21297-0365

The Division wants to help employers meet their unemployment insurance obligations.

- If you receive either of the notices described above, you may request a payment plan.

- After you file the missing reports and pay the delinquent contribution payments, you may also request interest and penalty waivers.

Quarterly Contributions and Payments Schedule

Contribution reports and payments are due:

- Quarter 1 - Due date is April 30

- Quarter 2 - Due Date is July 31

- Quarter 3 - Due Date is October 31

- Quarter 4 - Due date is January 31

Note: Reimbursable employers do not pay quarterly unemployment insurance taxes, but must reimburse the state for the benefit charges listed on the quarterly Statement of Reimbursable Benefits Paid.

Employers can file their contribution reports and submit payments in the Maryland Unemployment Insurance Portal (BEACON) by ACH Credit or ACH Debit.

- Maryland Unemployment Insurance Portal (BEACON) for employers login: employer.beacon.labor.md.gov

- Maryland Unemployment Insurance Portal (BEACON) for third-party agents login: agent.beacon.labor.md.gov

Employers can also pay by check. Make the check payable to the Maryland Division of Unemployment Insurance Fund and mail it to:

- Division of Unemployment Insurance

PO Box 17291

Baltimore, MD 21297-0365

Extensions

The Division does not offer extensions to pay contributions. However, the Division does encourage employers who are behind on contributions or having difficulty staying on time to request penalty and interest waivers and/or to opt into a payment plan.

To request a penalty interest waiver:

- Log into your Maryland Unemployment Insurance Portal (BEACON) account and select “Collections” from the left menu.

- Select “Request Waiver” from the drop-down menu.

- Select the year/quarter that you are requesting be waived. Provide the reason in the field and follow the prompts.

Frequently Asked Questions

The Maryland Department of Labor will make reasonable efforts to work with you to resolve your delinquent account. However, if you do not file a protest within 30 days, the Division of Unemployment Insurance will follow up with collection efforts to obtain the missing reports and payments in the employer’s accounts. The collection efforts may include legal actions, such as liens, corporation charter forfeiture, bank account garnishment, and interception of the delinquent employer’s funds. The Division may also flag the employer’s vehicle registration and business license.

Note: The Division may use the federal Treasury Offset Program to intercept delinquent funds.

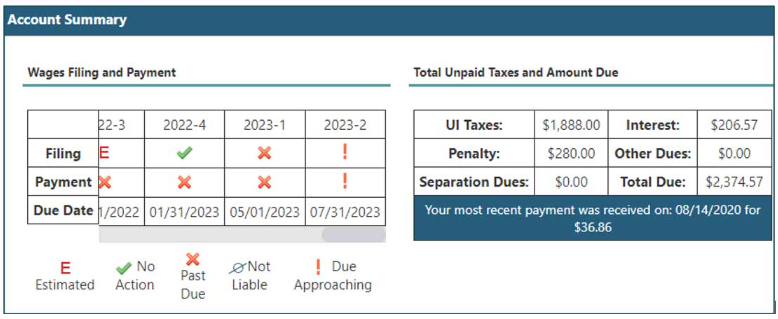

Employers and third-party agents can log in to the Maryland Unemployment Insurance Portal (BEACON) to check the status of their accounts, including submitted reports and payments received by the Division.

To do so, log in to yourMaryland Unemployment Insurance Portal (BEACON) account, where you will be taken to the home screen. This information is available under the Account Summary section.

- Maryland Unemployment Insurance Portal (BEACON) for employers login: employer.beacon.labor.md.gov

- Maryland Unemployment Insurance Portal (BEACON) for third-party agents login: agent.beacon.labor.md.gov

The interest charges are based on the rate of 1.5% per month on the late contribution payment due. The penalties are charged at $35 per quarter that is past due.

Employers and third-party agents can use the Maryland Unemployment Insurance Portal (BEACON) to request interest and penalty waivers, and payment plans.

- Maryland Unemployment Insurance Portal (BEACON) for employers login: employer.beacon.labor.md.gov

- Maryland Unemployment Insurance Portal (BEACON) for third-party agents login: agent.beacon.labor.md.gov

To request a penalty interest waiver:

-

Log into yourMaryland Unemployment Insurance Portal (BEACON) account and select “Collections” from the left menu.

-

Select “Request Waiver” from the drop-down menu.

- Select the year/quarter that you are requesting be waived. Provide the reason in the field and follow the prompts.

Confirmation that an interest and penalty waiver has been approved will be posted in the Maryland Unemployment Insurance Portal (BEACON).

If you have questions on the status of your waiver, please contact the Employer Call Center at 410-949-0033 or toll-free at 1-800-492-5524, Monday through Friday from 8 a.m. to 4:30 p.m.

After filing the missing reports and submitting the payments due on the account, no action will be taken against the employer’s account.

If you believe the Delinquency Notice is incorrect, please call the Employer Call Center at 410-949-0033 or toll-free at 1-800-492-5524, Monday through Friday from 8:00 a.m. to 4:30 p.m.

If you believe the Assessment Notice and Pending Civil Action Letter is incorrect, you can file a written request for review within 30 days of receiving the Assessment Notice and Pending Civil Action Letter by:

- Emailing ui.assessmentreviewdet@maryland.gov

- Mailing your request to:

-

Division of Unemployment Insurance

Legal Services and Collections

100 South Charles Street,

Tower 1, Suite 3100

Baltimore, MD 21201

Note: Please see your copy of the Delinquency Notice or the Assessment Notice and Pending Civil Action Letter for additional appeal instructions.

Please contact the Employer Call Center at 410-949-0033 or toll-free at 1-800-492-5524, Monday through Friday from 8 a.m. to 4:30 p.m.